Medical Debt Malpractice

Consumer Complaints About Medical Debt Collectors, and How the CFPB Can Help

Millions of Americans are contacted by debt collectors every year over debt related to medical expenses. "Medical Debt Malpractice" is the latest (9th) in our series based on analysis of complaints in the Consumer Financial Protection Bureau's public complaint database. The report demonstrates that the CFPB is a critical agency protecting consumers against unfair financial practices and needs to be defended against special interest attacks.

Downloads

Millions of Americans are contacted by debt collectors every year over debt related to medical expenses.

Medical debt collectors often employ aggressive tactics and attempt to collect debt from the wrong customers – putting consumers’ credit records at risk. Medical debt accounts for more than half of all collection items that appear on consumer credit reports. A review of 17,701 medical debt collection complaints submitted to the Consumer Financial Protection Bureau (CFPB) shows that problems with medical debt collection are widespread and harm Americans across the country.

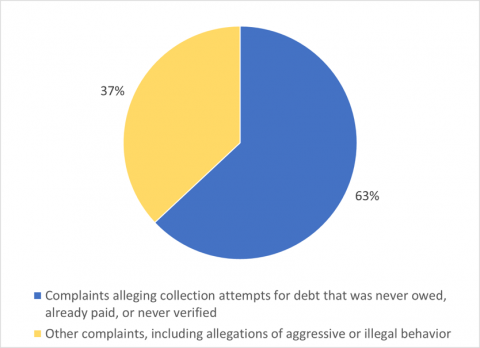

Complaints submitted to the CFPB suggest that many consumers contacted about medical debt should not have been contacted in the first place, and that many contacts involve aggressive or inappropriate tactics.

- Nearly two-thirds (63%) of complaints about medical debt collection assert either that the debt was never owed in the first place, it was already paid or discharged in bankruptcy, or it was not verified as the consumer’s debt.

- Many complaints document inappropriate and aggressive tactics including frequent or repeated calls, calls harassing friends and family, threats of legal action, or the use of abusive language.

- Although impacts on credit reports are not categorized by the CFPB, they appear to be a significant source of complaints: 1,810 complaint narratives, or 35 percent of medical debt collection complaints contained in the database, contain the text “credit report.”

Figure ES-1. Most Complaints Concern Attempts to Collect Debt of Questionable Legitimacy (Debt Consumers Believe Was Already Paid, Never Owed, or Not Verified)

A small number of companies are the subject of a disproportionate amount of total complaints.

- Just 10 companies account for more than 20 percent of all complaints.

- Tenet HealthCare, which ranks third for most medical complaints, was penalized in the CFPB’s largest enforcement action for illegal medical debt collection behavior.

Nevada has the most medical debt collection complaints per capita, with 11.4 complaints per 100,000 residents. Florida (9.3), Delaware (9.0), Georgia (7.7) and New Jersey (7.4) have the next highest rates of complaints per capita.

Medical debt collection affects a broad swath of the population and subjects millions of consumers to undue stress and financial harm. State and federal policymakers should work to protect consumers from unfair treatment by medical debt collectors. They should stop attempts to collect debts without proper information and documentation about the debt, stop debt collectors from bringing robo-signed cases in court, crack down on widespread use of threats, harassment and embarrassment in debt collection, and protect consumers from having their credit records unfairly affected by medical debt, among other actions.

Federal policymakers should also defend the CFPB against attempts to eliminate or cripple it, and should continue to ensure the CFPB has the resources, independence and tools at its disposal to effectively protect consumers from all kinds of predatory financial behavior.

Topics

Find Out More

Patient protections needed from medical credit cards

Did your insurance deny your health care claim? How to appeal.